A) its operating profit for the period will be higher than absorption costing.

B) its operating profit for the period will be lower than absorption costing.

C) its value of ending inventory reported in the balance sheet will be higher than absorption costing.

D) its operating profit will be the same under absorption costing.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Absorption costing is required by the Generally Accepted Accounting Principles (GAAP)for financial statements issued to investors,creditors,and other external users.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peter Newton,a production supervisor at BeThink Inc.,uses variable costing for any cost control decisions that he has to take.Which of the following is the reason for his choice?

A) fixed costs are not relevant in the long-run

B) only variable costs are controllable in the long and short run

C) absorption costing is not relevant for long-run decisions

D) lower management usually does not have control over most fixed costs

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costing methods charges all the manufacturing costs to the products?

A) variable costing

B) direct costing

C) absorption costing

D) contribution costing

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

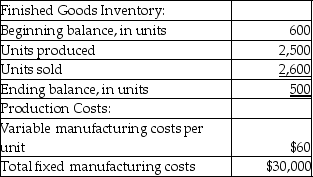

E-trax Inc.has provided the following financial information for the year 2015:  What is the unit product cost for 2015 using variable costing?

What is the unit product cost for 2015 using variable costing?

A) $72

B) $75

C) $60

D) $65

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

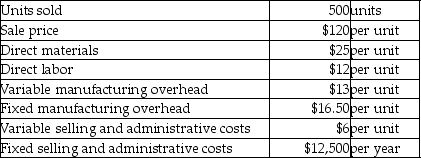

Groovelex Inc.reports the following information for the year ended December 31,2014:  -The operating profit calculated using variable costing and absorption costing amounted to $9,270 and $11,250,respectively.There were no beginning inventories.Determine the total fixed manufacturing overhead that will be expensed under variable costing for the year 2014.

-The operating profit calculated using variable costing and absorption costing amounted to $9,270 and $11,250,respectively.There were no beginning inventories.Determine the total fixed manufacturing overhead that will be expensed under variable costing for the year 2014.

A) $10,230

B) $8,250

C) $20,750

D) $25,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross profit is calculated by deducting ________ from sales revenue.

A) total fixed costs

B) cost of goods sold

C) total variable costs

D) selling and administrative costs

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Volplex Inc.produces paper and office supplies and uses the just-in-time inventory system.Currently,the company is using variable costing.Which of the following is true of the effect of costing systems on the financial results of Volplex?

A) Its operating profit will be significantly higher if the company uses absorption costing instead of variable costing.

B) Its operating profit will be significantly lower if the company uses absorption costing instead of variable costing.

C) Its operating profit will vary a little if the company uses absorption costing instead of variable costing.

D) Its operating profit will be negative if the company uses absorption costing instead of variable costing.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Variable costing prepares the income statement using the traditional format.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is considered a period cost under variable costing but not under absorption costing?

A) fixed selling and administrative costs

B) variable manufacturing costs

C) fixed manufacturing overhead

D) variable selling and administrative costs

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When production is more than sales,the operating income will be higher under absorption costing than variable costing.Assume zero beginning inventories.Which of the following gives the correct reason for the above statement?

A) all costs incurred have been recorded as expenses

B) a portion of the fixed manufacturing overhead is still in the ending Finished Goods Inventory account

C) all selling and administrative expenses have been recorded as period costs

D) fixed manufacturing costs have not been considered while calculating the operating profits

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When there is no beginning inventory and all the goods that are produced are sold,the operating income ________.

A) will be higher under absorption costing than variable costing

B) will be lower under absorption costing than variable costing

C) will be higher than the gross profit under variable costing

D) will be the same for both absorption costing and variable costing

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When all the units produced are sold,the profit calculated under absorption costing is higher when compared to the profit calculated under variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

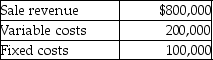

Jupiter Inc.reports the following information for August:  Calculate the contribution margin for the month of August.

Calculate the contribution margin for the month of August.

A) $450,000

B) $600,000

C) $700,000

D) $650,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Variable costing considers only ________ costs when determining product costs.

A) fixed manufacturing

B) variable manufacturing

C) variable selling and administrative

D) fixed selling and administrative

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

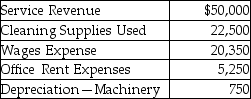

Perfect Clean Inc.provides housekeeping services.The following financial data has been provided.  - Calculate the contribution margin and the contribution margin ratio.

- Calculate the contribution margin and the contribution margin ratio.

A) $8,520; 17.0%

B) $7,550; 15.1%

C) $8,250; 16.5%

D) $7,150; 14.3%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

High-Tech Computer Services provide services to corporate and individual customers.During the month of June,the corporate business segment provided services to 500 customers and earned $60,000 in revenue.The individual business segment provided services to 400 customers and earned $35,000 in revenue.The variable costs for the corporate and individual business segment amounted $32,500 and $25,300,respectively.Additionally,the fixed costs of the company amounted to $8,500.The contribution margin ratios of the corporate segment and individual segment are ________,respectively.

A) 40.88% and 26.85%

B) 45.85% and 24.82%

C) 44.23% and 27.71%

D) 45.83% and 27.71%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true of variable costing?

A) It considers variable manufacturing overhead as period costs.

B) It considers fixed manufacturing overhead as product costs.

C) It considers variable selling and administrative costs as product costs.

D) It considers fixed selling and administrative costs as period costs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In its first year of business,Greenlam Inc.produced and sold 600 units.If Greenlam uses variable costing,________.

A) its operating profit for the period will be higher than absorption costing

B) its operating profit for the period will be lower than absorption costing

C) its value of ending inventory reported in the balance sheet will be higher than absorption costing

D) its operating profit will be the same under absorption costing

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

High-Tech Computer Services provide services to corporate and individual customers.During the month of June,the corporate business segment provided services to 500 customers and earned $60,000 in revenue.The individual business segment provided services to 400 customers and earned $35,000 in revenue.The variable costs for the corporate and individual business segment amounted $32,500 and $25,300,respectively.Additionally,the fixed costs of the company amounted to $8,500.Calculate the contribution margin from each corporate customer.

A) $24.25

B) $52.60

C) $56.40

D) $55.00

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 120

Related Exams