A) 0 units

B) 2 units

C) 8 units

D) 10 units

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wants to reduce smoking,it should impose a tax on

A) buyers of cigarettes.

B) sellers of cigarettes.

C) either buyers or sellers of cigarettes.

D) whichever side of the market is less elastic.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Long lines

A) and discrimination according to seller bias are both inefficient rationing mechanisms because they both waste buyers' time.

B) and discrimination according to seller bias are both inefficient rationing mechanisms because the good does not necessarily go to the buyer who values it most highly.

C) are an inefficient rationing mechanism because they waste buyers' time,and discrimination according to seller bias is an inefficient rationing mechanism because the good does not necessarily go to the buyer who values it most highly.

D) are an inefficient rationing mechanism because the good does not necessarily go to the buyer who values it most highly,and discrimination according to seller bias is an inefficient rationing mechanism because it wastes buyers' time.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a binding price ceiling is imposed on a market to benefit buyers,

A) every buyer in the market benefits.

B) every buyer and seller in the market benefits.

C) every buyer who wants to buy the good will be able to do so,but only if he waits in long lines.

D) some buyers will not be able to buy any amount of the good.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum wage laws

A) may encourage some teenagers to drop out and take jobs.

B) create labor shortages.

C) have the greatest impact in the market for skilled labor.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is not binding,then

A) the equilibrium price is above the price ceiling.

B) the equilibrium price is below the price ceiling.

C) it has no legal enforcement mechanism.

D) None of the above is correct because all price ceilings must be binding.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity sold in a market will decrease if the government decreases a

A) binding price floor in that market.

B) binding price ceiling in that market.

C) tax on the good sold in that market.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a result of rent control?

A) fewer new apartments offered for rent

B) less maintenance provided by landlords

C) bribery

D) higher quality housing

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

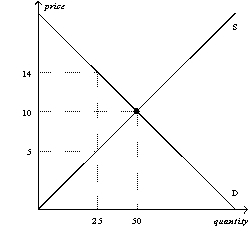

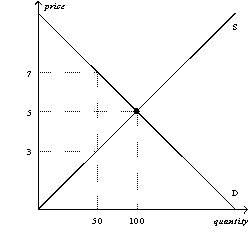

Figure 6-16  -Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.How much will sellers receive per unit after the tax is imposed?

-Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.How much will sellers receive per unit after the tax is imposed?

A) $5

B) between $5 and $10

C) between $10 and $14

D) $14

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct concerning the burden of a tax imposed on take-out food?

A) Buyers bear the entire burden of the tax.

B) Sellers bear the entire burden of the tax.

C) Buyers and sellers share the burden of the tax.

D) We have to know whether it is the buyers or the sellers that are required to pay the tax to the government in order to make this determination.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

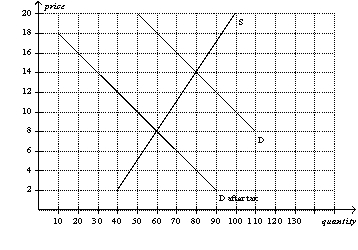

Figure 6-21  -Refer to Figure 6-22.How much tax revenue does this tax generate for the government?

-Refer to Figure 6-22.How much tax revenue does this tax generate for the government?

A) $150

B) $180

C) $250

D) $300

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling will be binding only if it is set

A) equal to the equilibrium price.

B) above the equilibrium price.

C) below the equilibrium price.

D) either above or below the equilibrium price.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage creates unemployment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Price ceilings are typically imposed to benefit buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

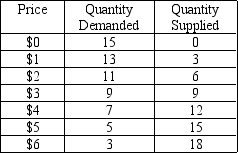

Table 6-3

The following table contains the demand schedule and supply schedule for a market for a particular good.Suppose sellers of the good successfully lobby Congress to impose a price floor $2 above the equilibrium price in this market.

-Refer to Table 6-3.Following the imposition of a price floor $2 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting shortage is

-Refer to Table 6-3.Following the imposition of a price floor $2 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting shortage is

A) 0 units.

B) 2 units.

C) 5 units.

D) 7 units.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $0.50 tax levied on the buyers of pomegranate juice will shift the demand curve

A) upward by exactly $0.50.

B) upward by less than $0.50.

C) downward by exactly $0.50.

D) downward by less than $0.50.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

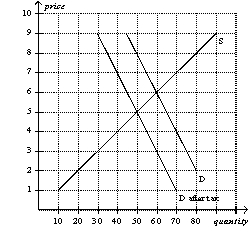

Figure 6-23  -Refer to Figure 6-23.The per-unit burden of the tax is

-Refer to Figure 6-23.The per-unit burden of the tax is

A) $4 for buyers and $6 for sellers.

B) $5 for buyers and $5 for sellers.

C) $6 for buyers and $4 for sellers.

D) $10 for buyers and $0 for sellers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A binding price ceiling may not help all consumers,but it does not hurt any consumers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-15  -Refer to Figure 6-15.Suppose a tax of $2 per unit is imposed on this market.How much will sellers receive per unit after the tax is imposed?

-Refer to Figure 6-15.Suppose a tax of $2 per unit is imposed on this market.How much will sellers receive per unit after the tax is imposed?

A) $3

B) between $3 and $5

C) between $5 and $7

D) $7

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is not binding,then

A) there will be a surplus in the market.

B) there will be a shortage in the market.

C) the market will be less efficient than it would be without the price ceiling.

D) there will be no effect on the market price or quantity sold.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 501 - 520 of 553

Related Exams