B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Regarding the net present value of a replacement decision, which of the following statements is false?

A) The present value of the after-tax cost reduction benefits resulting from the new investment is treated as an inflow.

B) The after-tax market value of the old equipment is treated as an inflow at t = 0 (initial investment outlay) .

C) The present value of depreciation expenses on the new equipment, multiplied by the tax rate, is treated as an inflow.

D) Any loss on the sale of the old equipment is multiplied by the tax rate and is treated as an outflow at t = 0 (initial investment outlay) .

E) An increase in net working capital is treated as an outflow when the project begins (initial investment outlay) and as an inflow when the project ends (terminal cash flow) .

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the text, the financial staff's role in the forecasting process centers on

A) Developing the original assumptions used in estimating each project's cash flows.

B) Making sure that no biases are inherent in the forecasts.

C) Deciding which projects are strategically important to the firm.

D) Setting the sales price and quantity estimates for use by other departments.

E) All of the above.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mom's Cookies Inc.is considering the purchase of a new cookie oven.The original cost of the old oven was R30,000; it is now 5 years old, and it has a current market value of R13,333.33.The old oven is being depreciated over a 10-year life towards a zero estimated salvage value on a straight line basis, resulting in a current book value of R15,000 and an annual depreciation expense of R3,000.The old oven can be used for 6 more years but has no market value after its depreciable life is over.Management is contemplating the purchase of a new oven whose cost is R25,000 and whose estimated salvage value is zero.Expected before-tax cash savings from the new oven are R4,000 a year over its full MACRS depreciable life.Depreciation is computed using MACRS over a 5-year life, and the required rate of return is 10 percent.Assume a 40 percent tax rate.What is the net present value of the new oven?

A) -R2,418

B) -R1,731

C) R1,568

D) R163

E) R1,731

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

It is extremely difficult to estimate the revenues and costs associated with large complex projects that take several years to develop.This is why subjective judgment is recommended for such projects instead of cash flow analysis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

With the current techniques available, estimating cash flows has become the easiest step in the analysis of a capital budgeting project.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Superior analytical techniques, such as NPV, used in combination with adjustments to the average required rate of return, can overcome the problem of poor cash flow estimation in decision making.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) An asset that is sold for less than book value at the end of a project's life will generate a loss for the firm and will cause an actual cash outflow attributable to the project.

B) Only incremental cash flows are relevant in project analysis and the proper incremental cash flows are the reported accounting profits because they form the true basis for investor and managerial decisions.

C) It is unrealistic to expect that increases in net working capital that are required at the start of an expansion project are simply recovered at the project's completion.Thus, these cash flows are included only at the start of a project.

D) Equipment sold for more than its book value at the end of a project's life will increase income and, despite increasing taxes, will generate a greater cash flow than if the same asset is sold at book value.

E) All of the above are false.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

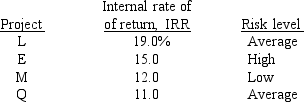

An evaluation of four independent capital budgeting projects by the director of capital budgeting for Ziker Golf Company yielded the following results:  The firm's weighted average cost of capital is 12 percent.Ziker Golf generally evaluates projects that are riskier than average by adjusting its required rate of return by 4 percent, whereas projects with less-than-average risk are evaluated by adjusting the required rate of return by 2 percent.Which project(s) should the firm purchase?

The firm's weighted average cost of capital is 12 percent.Ziker Golf generally evaluates projects that are riskier than average by adjusting its required rate of return by 4 percent, whereas projects with less-than-average risk are evaluated by adjusting the required rate of return by 2 percent.Which project(s) should the firm purchase?

A) Project L

B) Projects L and E

C) Projects L and M

D) Projects L, E, and M

E) None of the above is a correct answer.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company must ensure the safety of its work force.Two plans are being considered for the next 10 years: (1) Install a high electrified fence around the property at a cost of R100,000.Maintenance and electricity would then cost R5,000 per year over the 10-year life of the fence.(2) Hire security guards at a cost of R25,000 paid at the end of each year.Because the company plans to build new headquarters with a "state of the art" security system in 10 years, the plan will only be in effect until that time.Your company's required rate of return is 15 percent for average projects, and that rate is normally adjusted up or down by 2 percentage points for high- and low-risk projects.Plan 1 is considered to be of low risk because its costs can be predicted quite accurately.Plan B, on the other hand, is a high-risk project because of the difficulty of predicting wage rates.What is the proper PV of costs for the better project?

A) -R104,266.20

B) -R116,465.09

C) -R123,293.02

D) -R127,131.22

E) -R135,656.09

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

North West Mining is evaluating the introduction of a new ore production process.Two alternatives are available.Production Process A has an initial cost of R25,000, a 4-year life, and a R5,000 net salvage value, and the use of Process A will increase net cash flow by R13,000 per year for each of the 4 years that the equipment is in use.Production Process B also requires an initial investment of R25,000, will also last 4 years, and its expected net salvage value is zero, but Process B will increase net cash flow by R15,247 per year.Management believes that a risk-adjusted discount rate of 12 percent should be used for Process A.If California Mining is to be indifferent between the two processes, what risk-adjusted discount rate must be used to evaluate B?

A) 8%

B) 10%

C) 12%

D) 14%

E) 16%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial staff's role in the forecasting process includes all of the following except

A) coordinating the efforts of other departments, such as engineering and marketing.

B) ensuring that everyone involved in the forecasts uses a consistent set of economic assumptions.

C) making sure that no biases are inherent in the forecasts.

D) determine the appropriate discount rate for cash flows.

E) none of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following cash flows are incremental cash flows that need to be considered when evaluating a capital project?

A) Interest expenses on the financing of the project.

B) Sunk costs of engineering study to determine the feasibility of the project.

C) Opportunity cost of land being used for project that the firm already owns.

D) Both a and b are correct.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose a firm is considering production of a new product whose projected sales include sales that will be taken away from another product the firm also produces.The lost sales on the existing product are a sunk cost and are not a relevant cost to the new product.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although it is difficult to make accurate forecasts, the initial outlays and subsequent costs of large projects are forecast with great accuracy, but revenues are more uncertain and large errors are not uncommon.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Capital budgeting decisions must be based on the accounting income the project generates since shareholders are concerned with the reported net income the firm generates.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Replacement analysis involves the decision of whether to replace an existing asset that is still productive with a new asset.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When considering the risk of foreign investment, higher risk could arise from exchange rate risk and political risk while lower risk might result from international diversification.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not discussed in the text as a method for analysing risk in capital budgeting?

A) Sensitivity analysis.

B) Beta, or CAPM, analysis.

C) Monte Carlo simulation.

D) Scenario analysis.

E) All of the above are discussed in the text as methods of analysing risk in capital budgeting.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A sunk is a cash outlay that has already been incurred and that cannot be recovered regardless of whether the project is accepted or rejected.These sunk costs are extremely important in capital budgeting decisions.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 103

Related Exams